If you do know something about local clothing brands in China, you must have heard of Li Ning and Anta.

Li Ning was founded by Li Ning, one of the China’s most famous gymnasts, and Anta was founded by a Fujian businessman. In the perception of many Chinese, these two brands seem to be the first and second local clothing brands in China.

But in fact, this is not the case.

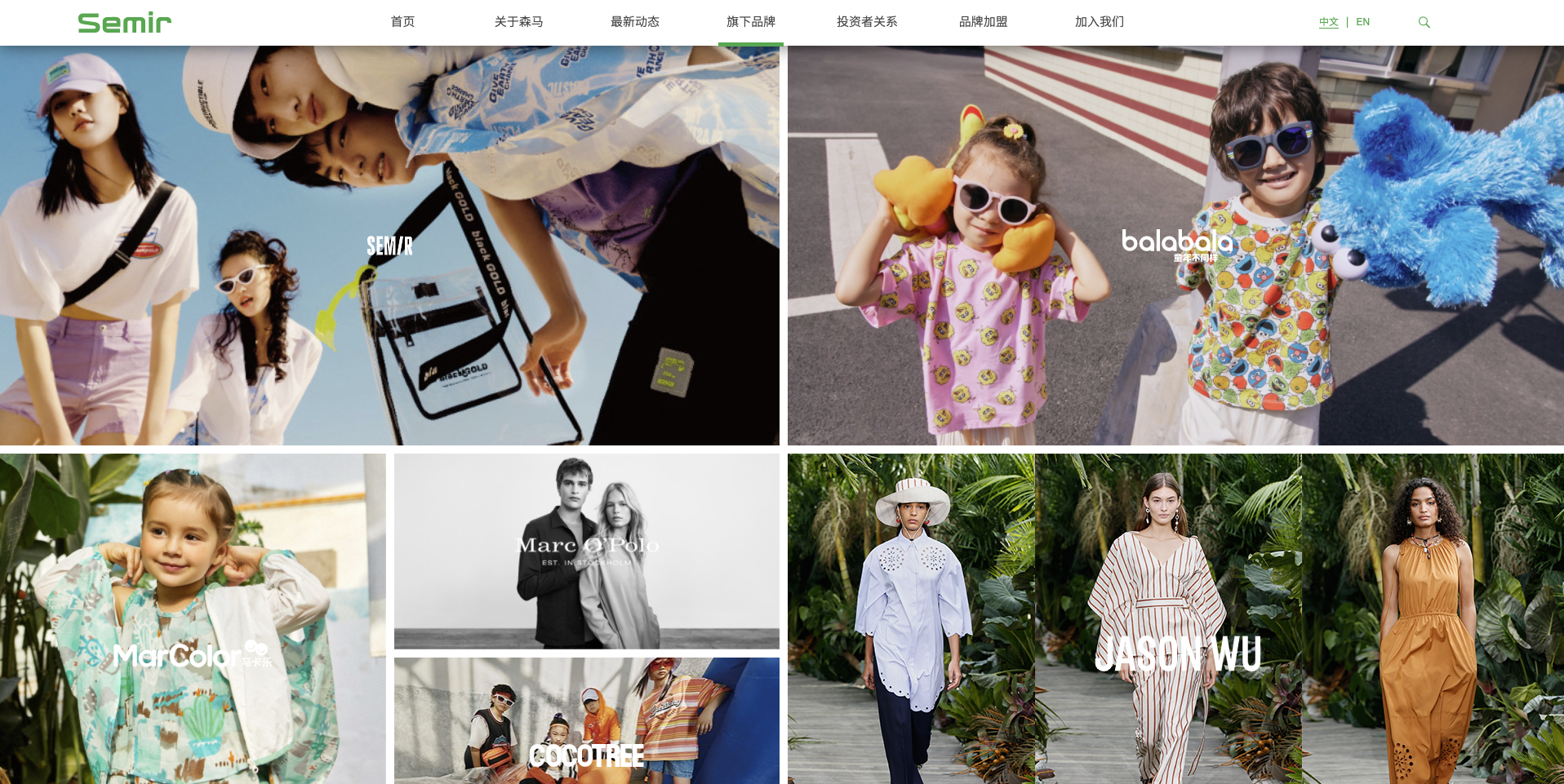

According to the income data, Anta ranked first with an income of 35.51 billion yuan ($5.503 billion) in 2020. But Semir, another Chinese clothing brand, surpassed Li Ning with annual revenue of 15.205 billion yuan ($2.356 billion).

According to data released by oIBP, Semir occupies the second place in China’s clothing market in 2020, following Uniqlo.

Semir’s success in China mainly depends on their diversification strategy. Although Semir was founded in 1996 as a brand for young Chinese consumers, yet after 2011, the company began to step up its efforts in children’s clothing business. It created a new children’s clothing brand Balabala.

In 2018, Semir also acquired Sofiza SAS, the owner of Kidiliz, a well-known children’s clothing brand. However, Semir sold Sofiza SAS later, and began to expand its overseas business.

In Semir’s 2020 financial report, sales of children’s clothing accounted for 66.64% of total revenue.

Unlike other clothing brands in China, the Semir brand is unfamiliar even to today’s young Chinese consumers. Now, let’s talk about the story of this enterprise.

Chairwarmer Semir

As a Chinese clothing brand born in 1996, the main brand of Semir seems lacking personality.

It does not have the outstanding corporate management skills of Anta, nor the distinct brand personality of Li Ning, nor the Internet model like Shein to grow rapidly outside China.

For a long time, Semir was regarded by Chinese consumers as “JackJones”, “MetersBonwe” and “YISHION” as similar brands. When you mention these brands to a young consumer living in a first-tier city in China, their first reaction is: “Ah? Hasn’t this brand closed yet? “

Today’s young consumers think that these brands of clothes are too “old” and that they are only “clothing brands” rather than “fashion brands”.

Although none of the above brands went bankrupt, Semir is indeed different from the others. For comparison, MetersBonwe, also considered a “third-tier brand” by young consumers, earned only 5.4 billion yuan ($837 million) in 2020, Semir was three times that of it. The development of the other three brands has stalled or even declined. But Semir is still in the first echelon.

This is mainly due to Semir’s diversification strategy.

After 2008, with the holding of the Beijing Olympic Games, Chinese consumers’ preference for clothing consumption had undergone unprecedented changes. The “casual clothing” that consumers once loved was no longer popular, and more and more consumers began to use sportswear as daily clothing. In this process, Li Ning and Anta were on the rise, and some overseas sportswear brands had also grabbed most of the market in China.

Established Chinese “casual wear” brands such as Semir began to feel pressure at this time, but unlike other brands, Semir opened up other paths before the storm.

Semir launched the children’s clothing brand Balabala, in 2002, nearly 15 years before Li Ning and Anta. This has also become the key to the success of Semir’s main brand after it was abandoned by consumers.

Instead of trying to catch up with Anta and Li Ning in the male clothing sector, Semir launched Minette, a clothing sub-brand for urban women in 2012. Right behind sportswear dominated the men’s wear market in China.

The brand focused on European design, which was completely contrary to the mainstream preference for performance in the market at that time, and captured the interest of some young Chinese female consumers.

After that, in order to meet both China’s first-tier city market and second-and third-tier city market, Semir launched two children’s clothing brands with different pricing strategies on the basis of Balabala.

In 2013, it became the distributor of the well-known German men’s wear brand Marc O’Polo in China, which saved the share lost by Semir’s own main brand in the Chinese men’s wear market.

Moreover, Semir’s diversification is not only in the field of clothing.

Semir and China Resources Group, a well-known real estate developer in China, jointly invested in a large commercial complex Wenzhou Hua Run vientiane city in 2012.

They even opened an amusement park for children in 2015 to boost the company’s children’s clothing sales. The park is called Mondodo Town. Mondodo is another children’s clothing brand owned by Smier.

Semir, which sold cosmetics in 2016, signed an agreement with South Korean cosmetics brand It’s skin and sold the brand’s cosmetics in 7500 Semir clothing stores in China. In 2018, Semir launched its own cosmetics sub-brand.

In 2018, Sema also invested in JWU, the parent company of Jason Wu, a Chinese-American designer of the same name.

In 2019, Semir launched a new cotton brand that sells not only close-fitting clothing, but also makeup remover, pillow towels, quilt covers, bed sheets and other products.

In 2020, Semir launched a new supermarket business. Semir’s supermarket chains are divided into three types: large integrated supermarkets in shopping malls, smart food markets for large residential areas, and small convenience stores for small communities.

Semir does not define its business as a strict supermarket, it is more like a community public space. According to Semir, community residents can not only buy what they want to buy here, but also find tailors, real estate agents, domestic companies, electrical repair and other services. In addition, it provides rentals for offices, conference rooms, yoga classrooms and dance studios for the community.

According to analysts, although many of Semir’s attempts have failed. But it is because of so many attempts that Semir has been able to get rid of brands that consumers regard as “similar” and move towards first-tier brands in China.

To some extent, this strategy of diversification is similar to that of Anta. We have explained this in detail in this article.

The early story of the founder of Semir

Semir’s early attempt to diversify has something to do with the experience of its founders.

Qiu Guanghe(邱光和) was 41 years old when he founded Semir, and this is not his first company.

Qiu was born in 1951 in a rural area of Wenzhou, Zhejiang Province, China. Three years ago, the People’s Republic of China was just founded and the whole country was very poor. Unfortunately, he was born into the poorest family in the poor countryside.

Qiu left junior high school at the age of 14 and began to help his parents cultivate in the farmland. In order to change his fate, he joined the army at the age of 16 and retired at the age of 20.

Qiu, who retired from the army, became a civil servant and later served as a factory director of a state-owned factory.

In 1984, the Chinese government began to encourage the development of commodity economy in China’s rural areas. Qiu and the village chief went to Hong Kong to inspect the household appliance industry, which inspired him. After returning to his hometown, he quickly set up an electrical appliance sales company. It was his first time to start a business, and he was 31 years old that year.

By selling electrical appliances, he quickly accumulated a net worth of 1 million yuan ($268000). At that time, the average monthly salary of Chinese urban residents was 100 yuan ($2.68).

But the good times didn’t last long. He soon lost almost all his assets and business because of a typhoon.

In August 1994, Typhoon Fred hit Wenzhou, Zhejiang Province. Qiu Guanghe’s electrical appliance warehouse was badly hit and most of the inventories were flooded. He lost tens of millions of yuan worth of inventory at one time, which brought his electronics business to an end.

It was only two years after China announced the full implementation of a market economy, and Qiu Guanghe, who realized the huge potential of the Chinese market, did not give up. He went to Zhengzhou, Henan Province to start a real estate brokerage business.

However, his second entrepreneurial career never yielded results, and Qiu was never a well-known real estate businessman, nor did he make more money during his two years in the real estate business.

However, during these two years, he began to pay attention to the clothing industry. He heard that the agency of an overseas clothing brand in a Chinese province sells for 1.2 million yuan every two years. This shocked him. He never knew that a clothing brand would be so valuable.

At the end of 1996, he returned to his hometown in Wenzhou, turned off all the rest and began to sell clothes with his son. Semir was officially established.

Semir in overseas market

With the rise of Shein, Semir has been actively expanding beyond China since 2016.

But Semir’s initial international strategy didn’t seem to be successful. The company bought French children’s clothing company Kidiliz in 2018, yet the brand has not been profitable since 2018. In August 2020, Semir sold ownership of the brand at a lower price than the purchase price.

After that, Semir began to sell overseas under its own main brand. In the women’s wear market in Europe and the United States, there is no doubt that the most famous brand from China is Shein. But in the menswear market, Semir is on the rise.

According to Semir’s 2020 results, the company’s sales outside Chinese mainland reached 1.242 billion yuan ($192 million), accounting for 8.17% of the company’s total revenue. But in fact, this figure has been affected by the COVID-19 epidemic.

In 2019, Semir’s overseas sales revenue reached 3.029 billion yuan (about US $469 million), accounting for 15.67% of Semir’s total revenue that year. This is an outstanding achievement in Chinese clothing enterprises.

Unlike Shein, Semir is not sold overseas entirely through online stores.

In January 2019, Semir officially established an overseas business center to promote the layout and development of Semir’s main brand and children’s wear brand Balabala in the international market. By the end of 2019, the two brands had opened 30 separate stores and counters in mainstream shopping malls and department stores in Saudi Arabia, Mongolia, Indonesia and other countries.

After the opening of the first store of the Barabara brand in the Vietnamese capital Hanoi Aeon Shopping Mall in November 2020, two stores were opened in Hanoi Savico Megamall and Haiphong Aeon Shopping Mall in December of the same year.

In response to the impact of COVID-19 on offline retail, Semir has also increased its investment in overseas e-commerce sites. Currently, official stores of Semir and Balabala can be found on AliExpress, Amazon, eBay and Lazada.

We have explained in our article on Shein that after the advent of e-commerce, tens of millions of Chinese businessmen try to sell Chinese low-tech goods to western markets through the Internet. But they don’t always try to build a long-term brand. Some of these Chinese exporters are even addicted to selling low-quality goods that cannot be sold in China’s local market through the Internet, while most companies with long-term brands in China do not sell any goods overseas.

Shein tries to change this model, and Semir is a follower of this strategy.

If you ask if Semir is a trusted brand, my answer is “yes”. It is a brand that has existed in China for 25 years.

Considering that China has been fully implementing a market economy for only 29 years, at least it will not disappear after selling to you, like other Chinese brands you encounter on Amazon and AliExpress.

Reference:

[1] 森马邱光和:投资地产失败后 靠卖衣服身家300亿

[2] 成为“全球最大的童装公司”,森马跨界、转型、翻身了?

[3] 线下品牌转型跨境电商躲不过的“三座大山”,森马如何一一踏平?

[4] 森马出海折戟 疫情下的本土服饰品牌路在何方?

[5] 进军卫生用品、化妆品行业,森马服饰为何“不务正业”

评论