As an American tech enthusiast residing in the bustling hub of Shanghai, the seismic shifts in China’s regulatory landscape are as palpable in the streets as they are in the boardrooms of the country’s tech giants. Today, I’m peering through the digital curtain to discuss the latest stratagem from China’s publication authority that has left the online gaming industry—and by extension, the chip market—reeling.

Imagine, for a moment, the fervor in arcades of yesteryear; the clinking of coins, the glow of pixelated screens, and the palpable excitement of gamers locked in digital combat. These scenes, which once epitomized gaming culture, are becoming historical relics as the industry pivots almost entirely online, where battles are waged across vast networks and continents in milliseconds. Yet, here in China, those connections are flickering out, quelled by the stroke of a regulatory pen.

In a move that sent shockwaves through the industry, China’s authorities have unfurled new directives aimed at curbing what they view as a societal scourge wrought by excessive gaming. These regulations aren’t just footnotes in policy journals; they carry the weight to dramatically alter the business models of gaming juggernauts and hobble an industry that’s been a beacon of growth and innovation within the tech sphere.

The rules, both stringent and unambiguous, impose a near-herculean clampdown on how often and how long players—especially the youth—can engage with online games. Consider the teenager who, until recently, could immerse themselves in virtual quests until the wee hours of the morning; they’re now relegated to a mere three hours on weekends, the only window permitted for their digital adventures. It’s as though the vast expanse of virtual realms has been shrunk down to a mere keyhole.

But this isn’t just about the kids and their screen time; the ripples of these regulations are expanding far beyond the gaming industry. Think of the silicon wafers and the intricate dance of electrons that power our digital experiences—they, too, are caught in the crossfire. The chip industry, a behemoth of technical wizardry, finds itself at the mercy of these new gaming limits. After all, every virtual world is built on a foundation of microchips, each one an ode to human ingenuity. With gaming in China being a critical pillar for chip demand, the implications of these curbs stretch into foundries and design labs across the globe.

Thus, we stand at the precipice of a chilling narrative, wherein China’s gaming regulations may very well be writing the first chapter of a somber tale for the future of the chip market. Stick with me, and let’s delve deeper into these new regulations, unravel their immediate impacts, and discover how an industry once thriving under the grace of leniency now faces a future clouded with uncertainty.

As we sink deeper into the labyrinth of China’s new gaming edicts, the devil, as they say, is in the details. The National Press and Publication Administration (NPPA), a regulatory arm with eyes fixated on the nation’s gaming scene, has not simply adjusted the dials; they’ve initiated a sweeping transformation that puts stringent caps on the virtual escapades of millions.

Key among these measures is a stringent leash on the digital playground for minors. Envision the youth of China, once free to traverse gaming universes without restraint, now confined to a meager allowance of screen time: just three hours, strictly on the weekends. This concrete rule shatters the former routine where weekdays offered a blissful hour and holidays two hours of gaming refuge. The intention is clear: a bid to snuff out gaming addiction and foster what is perceived as healthier habits in the country’s younger generation.

But the extent of control doesn’t halt there. Tighter scrutiny of user identity is now paramount, with all players required to register under real-name identification systems. Anonymity in the gaming realm is thereby dissolved, linking every quest and conquest back to a real-world persona—a policy echoing concerns of privacy in the digital age.

The gavel comes down harder still:

On December 22, 2023, the State Press and Publication Administration issued the “Online Game Management Measures (Draft for Comments)”, aiming to strengthen industry standard management and promote high-quality and sustainable development. This draft for comments mainly contains the following important provisions:

- Online games are not allowed to set inductive rewards such as daily login, first-time recharge, continuous recharge, etc. Online game publishing and business units shall not provide or condone high-priced transactions of virtual props in the form of speculation, auctions, etc.

- For online games that contain prohibited content, the publishing authority will order the relevant content to be deleted and corrected within a time limit, and the illegal gains will be confiscated.

- Regulations on the use of online games by minors include strictly controlling the period and duration of use of online games by minors, prohibiting minors from logging into games that are likely to lead to addiction, and containing content that is not suitable for minors, and strictly enforce the regulations. Restrictive requirements for minors to provide paid services. Minors are not allowed to provide account rental and sales, game currency and virtual props trading services, as well as third-party services such as sparring and playing on behalf of minors. Random drawing services are not allowed to be provided to minors. Online Minors are not allowed to reward game live broadcasts.

- Online game publishing and operating units should verify the true identity information of minor users through necessary means such as a unified electronic identity authentication system for minors’ online games.

- Online game publishing and operating units should establish and improve game rules to prevent minors from becoming addicted to the Internet, and prevent minors from being exposed to game content or game functions that may affect their physical and mental health.

- All online games must set user recharge limits. When providing random drawing services, online game publishing and operating units should make reasonable settings for the number of draws and probabilities, and must not induce excessive consumption by online game users.

- When an online game publishing business unit terminates the publication and operation of online games, the online game users’ unused online game coins and unexpired game services shall be refunded to the users in legal currency according to the proportion of the user’s purchase. Accept other methods for returns and exchanges.

- The standards for issuance and purchase of online game currency must be transparent and reasonable. The scope of use of online game currency is limited to the exchange of online game products and services provided by itself, and may not be used to pay, purchase physical goods, or exchange for products and services of other entities.

- It is not allowed to provide users with the service of exchanging online game currency for legal currency, except when the online game publishing business unit terminates the provision of online game products and services and returns unused online game currency to the user in the form of legal currency or other methods accepted by the user.

- Transaction services for unapproved online games shall not be provided. Online game currency transactions shall be conducted using real-name digital RMB wallets, and anonymous digital RMB wallet transaction services shall not be provided to users.

Within this framework of frugality and monitored moderation, the aftershocks were immediate and far-reaching. Gaming stocks, once soaring on the thermals of speculation and profit, plummeted earthwards as if clipped by invisible forces. Tencent, a colossus in the global gaming industry, watched over $43 billion evaporate from its market value, a stark testament to the market’s jittery reaction. It’s a script we’ve seen before—regulatory clampdown followed by investor retreat—but the scale here is nothing short of dramatic.

It wasn’t just the titans that felt the tremors; smaller developers, reliant on each micro-transaction and daily engagement metric, suddenly found themselves navigating a landscape where the rules of the game had changed overnight. Without the leverage of big-brand portfolios or established franchises, these studios now grapple with an existential question: How to captivate and monetize in a regime of restriction?

These restrictions aren’t merely paper tigers; their bite is already being felt across the industry. The NPPA’s draft rules push back against incentives that drive gamers to log in daily or to top up their game wallets, strategies employed by nearly all in the gaming realm to boost player engagement and revenue. It’s a sobering turn for an industry often characterized by its dynamic, if not frenetic, pace of innovation and marketing.

The underpinnings of these regulations lie in a perceived need for social rectification. A battle, if you will, against what the state sees as the ills of gaming—an electronic opiate dulling the minds and potential of the nation’s youth. And while the intentions might revolve around shaping a more productive and less game-intoxicated society, the rippling effects of such drastic steps are sending shockwaves through the digital ecosystem.

But it’s not just about the immediate plunge in stock prices or the scrambling developers—it’s the reverberations felt throughout the economic fabric that underpins gaming. Advertisers, who once basked in the glow of guaranteed impressions and clicks from this lucrative demographic, now face a shrinking platform. After all, with fewer hours of gameplay come fewer opportunities for ads to make their mark.

The industry’s response oscillates between innovation and outcry. Some insiders suggest a pivot towards overseas markets to bypass domestic constraints, while others prophesy a renaissance of gaming experiences tailored to comply with the new norm. Regardless of the direction taken, the reality remains that China’s gaming landscape has been forever altered by the stroke of regulatory intent.

In this stark new dawn, it’s imperative to consider not just the ripples, but the potential tidal waves these regulations may unleash. As I foreshadowed, our next step is to wade into the chip industry—an ocean of complexity and technical marvel—now facing the squalls stirred up by the tempest of China’s gaming regulation overhaul.

The regulations overhauling China’s gaming industry not only cast long shadows across the vibrant landscape of digital escapism but also send a chill through the semiconductor sector. For chip manufacturers and suppliers, the gaming industry has long been akin to a parched desert traveler finding an oasis—the thirst for high-performance chips used in gaming consoles, PCs, and mobile devices has been unquenchable. Now, the flow of revenue could slow to a trickle, as the gaming oasis seems to shrink under the regulatory glare.

Let’s take a granular look at how an industry that often rides the high wave of consumer tech demands, particularly from gaming, might find itself suddenly navigating choppy waters.

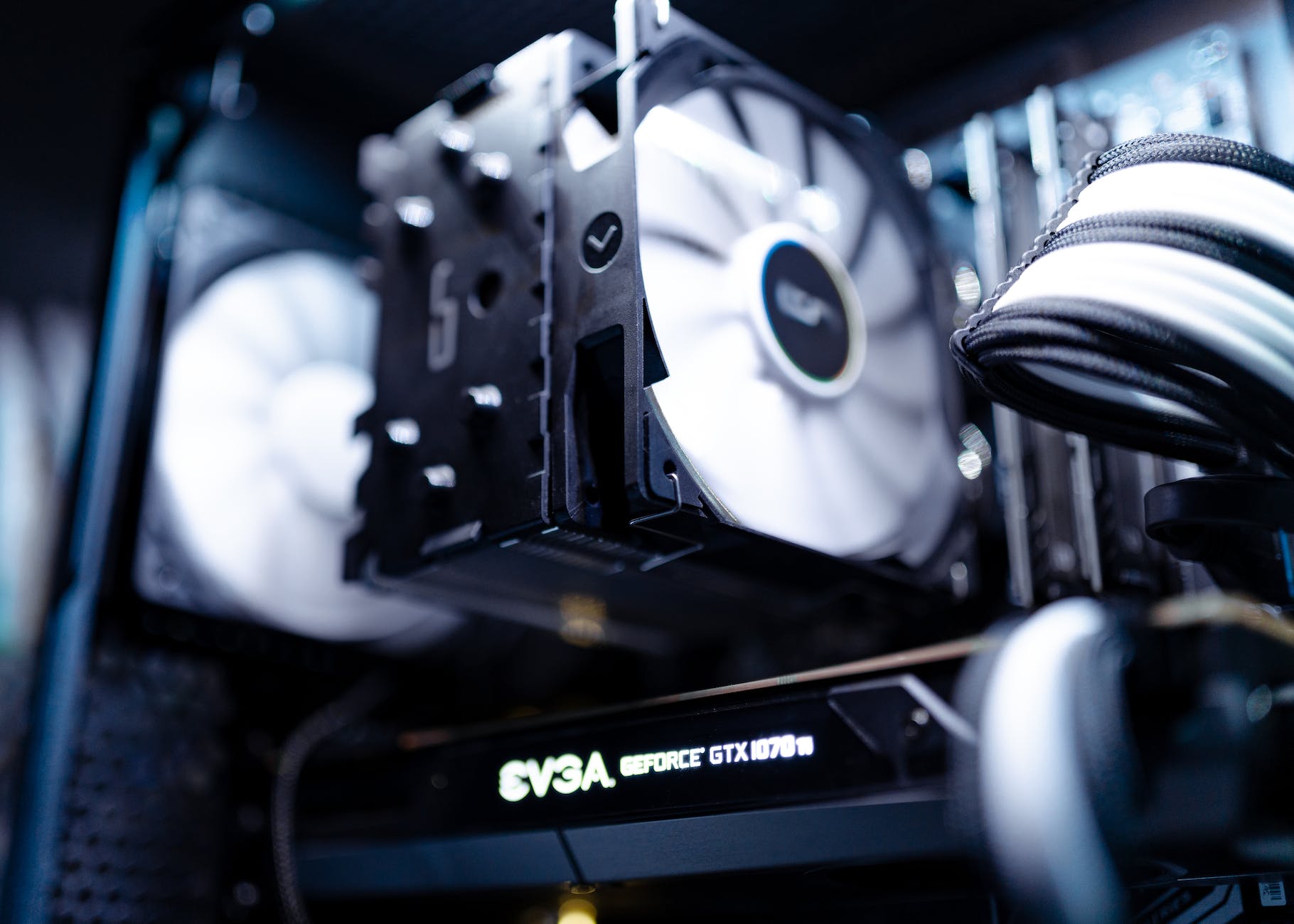

High-performance computing chips, especially GPUs (Graphics Processing Units), sit at the heart of the gaming experience. They’re the sinew and muscle that render the lush visuals gamers crave, and the gaming industry has been driving their evolution with an insatiable appetite. NVIDIA and AMD are two giants in this race, perennially pushing the limits of what these silicone marvels can achieve, but they are not alone. Lesser-known players specializing in mobile chipsets also jostle for their share of the pie.

The regulations in China—home to the world’s largest gaming market—pose an unanticipated disruption. With gaming time now capped for minors and in-game purchases curtailed, the market dynamics are poised to shift. The logic is simple: less game time translates to reduced exposure to advanced graphics, potentially deflating the demand for the latest and most powerful chips.

This reduction in demand could ripple out in several ways. First, the rate of obsolescence for existing hardware may slow. If gamers are playing less, they’re less likely to push their systems to the limits, which means they’ll feel less pressure to upgrade their rigs. The bleeding edge of technology thrives on the push for better, faster, and more powerful, but if a significant portion of the market hits the pause button, the cutting edge becomes less of a battlefront.

Moreover, manufacturing plans for chipmakers, meticulously forecasted and planned around growth trajectories, may require recalibration. The industry operates on razor-thin margins and extreme efficiency—any excess inventory due to an overestimation of demand can lead to price slashes, which in turn can erase profits. The perilous balance between supply and demand is now threatened, casting a shadow of uncertainty over the manufacturing pipelines.

It’s not just the high-end chipmakers that will feel the squeeze. The entire supply chain, from those supplying raw materials to those involved in the intricate manufacturing process of chip production, faces a potential downturn. As the larger names reel from the impact, their order books might thin out, echoing down the tiers of suppliers who depend on steady orders to keep their operations humming.

Another layer of complexity arises when considering the R&D aspect. Chip design is a herculean task, blending electrical engineering, physics, and computer science into a process that can take years and consume vast resources. The immense cost of developing a new generation of chips hinges on projected returns from markets like gaming. If the horizon looks less promising, the willingness to invest in next-generation R&D could wane.

China’s chip industry, although burgeoning, still lags behind in some areas, particularly in the high-performance segment largely driven by gaming. The regulatory squeeze might force a reorientation towards other sectors. However, this isn’t a simple pivot. Each sector has its unique demands and timelines. The automotive industry, for instance, is hungry for chips, but the design and certification process can be far lengthier than for gaming chips.

In the immediate term, global chip companies will likely look to other markets to offset losses in China, but this isn’t just a switch one flips. Emerging markets with growing gaming populations might not yet have the infrastructure or consumer spending power to fully substitute for China’s previously explosive demand.

Lastly, consider the subtler impact on consumer behavior. The buzz around gaming hardware often translates to excitement about technology as a whole. It’s a feedback loop where cutting-edge gaming experiences drive interest in high-end hardware, which in turn pushes tech enthusiasts to explore what’s possible. Curtailing gaming might not just reduce the need for newer, faster chips—it might also dampen the enthusiasm that spurs the tech industry forward.

The bottom line is that China’s gaming regulations create an unanticipated headwind for an industry already coping with global supply chain challenges and geopolitical tensions. While the full extent of these regulations’ impact on the chip industry remains to be seen, the certainty of change is palpable, and the journey ahead for chip manufacturers and suppliers looks to be one of adaptation and resilience in the face of adversity.

The relationship between the gaming industry and the chip industry is a symbiotic dance that dates back over three decades. It’s a history of mutual propulsion where each step forward in gaming technology necessitated an equal, if not more significant, stride in chip innovation.

In the late 20th century, as gaming consoles invaded living rooms with increasing regularity, the demand for more powerful chips skyrocketed. The simple sprites and backgrounds of early video games gave way to the need for more sophisticated graphics, rendering capabilities, and processing speeds that pushed the boundaries of contemporary chip technology. Silicon giants like Intel, AMD, and later NVIDIA rose to the challenge, not only because the burgeoning gaming market demanded it, but because their growth and future depended on it.

Games like ‘Doom’ and ‘Quake’ in the 90s were benchmarks of progress, demanding more from the hardware they ran on. Every advance in game complexity and visual fidelity became a direct signal to chipmakers: innovate or fall behind. The graphics processing unit (GPU), once a peripheral component, became central to the gaming experience, and the drive to improve GPU technology became synonymous with gaming’s march toward hyper-realism.

By the early 2000s, GPUs became the golden geese of the semiconductor industry, with NVIDIA’s GeForce series and AMD’s Radeon line being the poster children of this new era. The term ‘gaming graphics card’ entered the mainstream lexicon, implying hardware purpose-built for the gaming demographic’s hunger for visual splendor and fluid gameplay.

It wasn’t just the premium market segment that saw growth. The mid-range and budget markets expanded as well, with chips tailored for casual gamers and enthusiasts who couldn’t shell out top dollar but still craved a quality gaming experience. The chip industry adjusted its offerings to cater to a broader audience, from hardcore gamers to those who just wanted to dabble in the virtual realms after work or school.

The introduction of multi-core processors in the mid-2000s further fueled this evolution. Games began to harness the power of parallel processing, allowing for more sophisticated physics, AI, and real-time game logic that mirrored the complex nature of the real world. This shift saw chipmakers like Intel stepping up their game, with the Core series processors finding a solid foothold in the market.

As gaming went online, so did the demands on processing power. Multiplayer experiences meant more data processing, and hence, more powerful network chips. Online gaming was no longer a niche; it became a global phenomenon that connected millions and, in the process, reinforced the need for robust chipsets that could handle the constant exchange of digital information in real time.

With the explosive popularity of mobile gaming in the late 2000s and early 2010s, a new frontier opened up. Mobile processors and GPUs began to compete with their desktop counterparts, and companies like Qualcomm and MediaTek emerged as critical players. The Snapdragon and Helio processors, for instance, became common talking points in the discussion of a phone’s gaming capabilities.

The console gaming sector continued to influence chip development, with each generation of PlayStation and Xbox consoles presenting leaps in processing capability and graphical output. These consoles set a benchmark for what was possible in gaming, directly reflecting the state of chip technology at any given time.

In the PC world, the gaming community’s penchant for custom builds fostered an entire industry of aftermarket parts. This pushed chipmakers to continuously innovate, ensuring their products could be seamlessly integrated into a myriad of configurations that enthusiast gamers put together. The DIY PC building craze of the 2010s was a testament to the deeply entrenched relationship between gamers and the tech that powered their passion.

At the core of this technological symbiosis is the ever-escalating demand for realism, immersion, and connectivity in gaming. This has transformed chip manufacturers into veritable partners of the gaming industry. To use a gaming metaphor, chipmakers don’t simply supply the weapons; they forge them, sharpen them, and sometimes even help design the battles in which they’ll be used.

This decades-long interplay has not been without its challenges. The ever-increasing complexity of games, coupled with the rate at which gaming technology has advanced, has necessitated an almost frenetic pace of innovation from chipmakers. It has been a high-stakes game where the ability to predict and shape future trends is as crucial as responding to current demands.

In the end, gaming consumers, with their relentless pursuit of a more profound gaming experience, have continually shaped the trajectory of chip technology. Their demands for richer graphics, faster gameplay, and seamless online experiences have made gaming a formidable force in the chip industry, guiding it through various eras of technological advancement. The result is a tech ecosystem in which the chipset in a gamer’s console or PC is not just a component; it’s the heartbeat of a digital revolution that shows no signs of slowing down.

As the new millennium dawned, China’s technological landscape was on the cusp of a dramatic transformation. The year 2000 marked the end of a sweeping ban on gaming consoles, a prohibition that had stifled the development of the country’s computer industry for nearly a decade. This pivotal moment set the stage for an unprecedented surge in technological advancement and industry growth, fueled in large part by the resurgence of gaming.

The ban, which had been implemented in 2000, was rooted in concerns about the potential harm to the physical and mental well-being of young people. However, it inadvertently crippled the domestic video game market and, by extension, the incentive for innovation within China’s chip and computer manufacturing sectors. As a result, the nation’s youth turned to internet cafes and the burgeoning realm of PC gaming, which existed in a legal gray area that allowed it to flourish despite the console ban.

It’s important to understand the context of China’s computer industry at the time. Prior to the lifting of the ban, China was not known as a leader in computer technology. Computers in the country were primarily used for basic office tasks and internet browsing, with little focus on high-performance computing or gaming. The demand for advanced chips and graphics processors was minimal, as there was no significant market for them.

When China eventually repealed the gaming console ban in 2014, it ignited a revolution within the country’s technology sector. The reintroduction of consoles from giants like Sony, Microsoft, and Nintendo reinvigorated consumer interest and opened up a new arena for competition and innovation. Chinese companies, recognizing the potential for massive growth, started pouring resources into research and development for computer hardware that could cater to the gaming market.

One of the most significant advancements in the wake of the ban’s lifting was the development and expansion of homegrown companies. For instance, Lenovo, which had acquired IBM’s PC division in 2005, began to capitalize on the newfound interest in gaming by manufacturing high-performance computers and laptops. Similarly, Chinese internet company Tencent swiftly expanded its gaming division, eventually becoming one of the largest video game companies in the world.

This resurgence of gaming also brought about an increased demand for high-quality graphics cards and processors. In turn, it spurred growth in the semiconductor sector, with companies like Semiconductor Manufacturing International Corporation (SMIC) and HiSilicon, a subsidiary of Huawei, ramping up production to meet the needs of both console and PC gamers.

Another key development during this time was the rise of esports in China. With gaming now a legitimate and thriving industry, competitive gaming events drew large audiences, and players became celebrities. This further drove the demand for gaming-capable computers, and with it, a need for chips that could deliver the high performance required for professional-level play.

China’s computer industry also began to see an increased collaboration with international chip manufacturers. Companies like Intel and AMD started to see China as not just a manufacturing hub but also a key market for their high-end products. Partnerships and joint ventures became more commonplace, as international firms looked to tap into the fast-growing Chinese market while domestic companies sought to leverage the expertise of established players.

Moreover, China’s computer industry’s growth trajectory was bolstered by government policies aimed at transforming the country into a tech powerhouse. Initiatives like the “Made in China 2025” plan placed an emphasis on the development of high-tech industries, including computer electronics and semiconductors. The government’s investment and subsidies in these sectors provided additional fuel for the fire, accelerating advancement and innovation.

One must also consider the cultural shift that occurred as gaming grew more popular. Video games became a primary form of entertainment and social interaction, especially among the younger generation. This cultural embracement further cemented the role of computers in everyday life, extending well beyond gaming. Computers were now essential for communication, work, and creative endeavors.

In the span of just a few short years, China’s computer industry had transformed from a market primarily concerned with basic computing needs to one that stood at the forefront of gaming and high-performance computing. The lifting of the gaming console ban played a pivotal role in this evolution. It wasn’t simply the reintroduction of consoles that fueled this change but the broader implications it had for consumer expectations, business investments, and government policies. The demand for better, faster, and more powerful computing devices drove technological innovation, and in turn, the tech industry helped shape the cultural landscape.

Thus, by the mid-2010s, China had firmly established itself as a major player in the global computer market, with a burgeoning industry that continues to show immense potential for growth and innovation. The country had transitioned from an environment where gaming was suppressed to one where it became a cornerstone of technological progress—a testament to how policy shifts can unleash latent market forces, propelling an entire industry forward.

Mobile gaming in China hasn’t just been a pastime; it’s been a juggernaut driving technological innovation and economic growth. Even as console gaming faced strict regulations, mobile gaming operated with far fewer restrictions, creating an environment ripe for growth and opportunity. This lack of limitations not only spurred the popularity of mobile games among consumers but also catalyzed the ascent of China’s smartphone industry to global dominance.

Let’s rewind to the early 2000s, a time when the mobile phone market was largely commanded by Western and Korean companies. However, as Chinese tech companies started investing in smartphone technology and the mobile gaming industry, they found themselves in a race where they held a home-field advantage: a massive population eager to adopt new technology and an undying love for gaming.

The Chinese mobile gaming market skyrocketed, driven by an audience that was traditionally underserved by gaming consoles due to the 2000 ban. Unlike the console market, which required dedicated hardware, mobile games were accessible to anyone with a smartphone. They didn’t require a separate device or a trip to an internet café – gaming could be woven into the fabric of everyday life, filling the gaps during commutes, lunch breaks, and any other spare moment.

This meteoric rise in mobile gaming did more than just create a new category of entertainment; it pulled the Chinese smartphone industry along with it. Companies such as Huawei, Xiaomi, Oppo, and Vivo saw an opening. They understood that for mobile games to run smoothly, phones needed better displays, more powerful processors, and longer battery life. In turn, as these companies innovated to meet the demands of gamers, they began to produce smartphones that were on par with – if not superior to – international brands.

Smartphones became more than communication devices; they transformed into hand-held gaming consoles. This shift created a huge demand for advanced mobile technology, making the smartphone market in China fiercely competitive and incredibly lucrative. The country’s tech giants poured considerable resources into research and development, rapidly iterating and releasing new models that pushed the boundaries of what smartphones could do.

This fierce competition led to rapid advancements in technology and a dramatic drop in prices. Chinese consumers, who were historically price-sensitive, could now access high-quality smartphones at affordable rates. This democratization of technology led to increased market penetration, and soon enough, everyone had a powerful gaming device in their pocket.

Chinese smartphone manufacturers didn’t stop at their borders. They looked outward, realizing that the technologies developed for gaming – high-resolution screens, touch controls, efficient chipsets – were coveted worldwide. As they expanded internationally, they leveraged their expertise in mobile gaming to drive sales, offering superior gaming experiences at more accessible price points compared to their Western counterparts.

The international market was ripe for the taking. Emerging markets, in particular, were drawn to the value proposition offered by Chinese smartphones. Aided by aggressive marketing and strategic partnerships, Chinese brands quickly climbed the ranks of the global smartphone market. At the same time, the country’s regulatory environment continued to support domestic companies over foreign competitors, further fueling growth and innovation.

The symbiotic relationship between mobile gaming and the smartphone industry resulted in an incredible feedback loop. The popularity of mobile gaming drove the demand for better smartphones, which in turn made mobile gaming more accessible and enjoyable, leading to even higher demand. This cycle propelled China’s smartphone manufacturers to the forefront of the global stage, making them leaders in the market.

The success of China’s smartphones isn’t just a story of business savvy or technological advancement; it’s a testament to the role of mobile gaming as a driving force in the tech industry. It reflects a strategic alignment with cultural trends and consumer behavior, as well as an agile response to regulatory landscapes.

As mobile gaming continues to evolve, with innovations like augmented reality and 5G connectivity, China’s smartphone manufacturers are well-positioned to lead the charge. With a homegrown ecosystem of apps and games, a deeply embedded gaming culture, and the technological prowess to back it up, China’s smartphones have become a force to be reckoned with, capable of shaping the future of not just mobile gaming, but also global technology trends.

Historical patterns have a peculiar way of echoing into the present, and in the case of China’s stringent approach to its gaming industry, the reverberations seem particularly acute. The turn of the millennium marked a significant juncture for China’s tech space with the 2000 ban on gaming consoles. It was a move that stifled the domestic growth of not only gaming but also the ancillary industries that thrived around it – including the chip market. Fast forward to the present day, and we see China’s regulators wielding a similar hammer with new gaming regulations. This invokes a necessary comparison: Could these new restrictions herald a repeat of the tribulations from two decades ago, or might they precipitate even graver consequences for China’s burgeoning chip and digital sectors?

To dissect this, let’s first consider the scope of the 2000 ban. The prohibition, instated out of concern for potential negative effects on the youth, prevented the sale of gaming consoles across China. This effectively excised a chunk of the global market for console manufacturers and simultaneously starved the domestic market of technological and entertainment progress that was being enjoyed elsewhere. In consequence, the ban didn’t just hinder the gaming industry but inadvertently shackled the associated hardware market as well. Without consoles, the demand for advanced chips that powered them wasn’t just diminished, it was essentially non-existent in the Chinese market. This gap left by the ban would persist for 14 years, and during that time, China’s tech industry could have been making strides in the chip sector alongside international competitors.

Now, the present-day regulations have emerged at a time when China has established itself as a powerhouse in technology, particularly in mobile gaming and smartphone manufacturing. Yet, these new regulations appear to present a slate of limitations that echo the restrictions of the past. The rules – which clamp down on the amount of time minors can spend gaming, curtail the approval of new game titles, and propose mechanisms to cap individual spending on games – seem to straitjacket the industry. While the intentions behind these regulations may stem from concerns regarding gaming addiction and excessive screen time for minors, their ripple effects could be far-reaching.

The connective tissue between these regulations and the health of the chip market becomes palpable when you consider the intricate relationship between gaming and semiconductor technology. Gaming has perpetually pushed the envelope on what chips can do, demanding more power, better graphics, and greater efficiency. When regulations like these impede the gaming industry, they inadvertently apply the brakes to the demand for advanced chip technology.

Notably, the impact of such regulations reaches beyond the borders of gaming and has implications for the trajectory of innovation within China’s chip industry. If history is anything to go by, the chill that swept over China’s technology market post-2000 could well be a prelude to the frost settling in now. The aftermath of the console ban revealed a stark retardation in technological advancement within China’s gaming and computing hardware sectors. Under the shadow of the new regulations, the chip market faces the risk of a similar downshift. A restricted gaming sector could see reduced investment in chip innovation, leading to a loss of competitive edge in the international market where gaming continues to be a driving force.

Moreover, considering that China has only recently emerged from the console ban shadow, these new regulations could not have come at a more delicate time. The country’s tech industry, including its burgeoning chip market, is at an inflection point; strides in innovation and international competitiveness are only just gaining momentum. This makes the potential impact of the new regulations all the more concerning. The chip industry, inherently linked to the fortunes of gaming, may witness a contraction or, at the very least, a deceleration in growth as a direct result of a suppressed gaming ecosystem.

Even as China strides towards self-sufficiency in chip production, the regulatory straitjacket could curtail this momentum by shrinking domestic demand and disincentivizing innovation. It’s a scenario that not only echoes the direct aftermath of the 2000 ban but also raises the specter of an amplified recurrence, given the now-global relevance of China’s digital market.

To contemplate the broader spectrum of possibilities, the restrictions today could indeed deal a blow more crippling than the previous console ban. The scale and integration of China’s chip market with the global economy is far more extensive now than it was at the dawn of the millennium. The current regulations, therefore, have the potential to set off a chain reaction, impacting global supply chains, international trade relations, and the global competitive landscape. It may dampen the spirits of foreign investors, who could view the policy landscape in China as increasingly unpredictable and restrictive, further influencing the global perception of China’s business environment.

Comparing the two regulatory regimes isn’t just an academic exercise – it’s a practical one that may hold the key to understanding the future trajectory of China’s digital economy. The new gaming regulations, much like the 2000 ban, have the potential to act as a stranglehold on multiple sectors, including the chip industry. They risk not only stalling progress but also rolling back the hard-earned gains of the past two decades. The parallels drawn from the 2000 ban to today’s regulations suggest that without a conducive policy environment, China’s chip and digital markets may once again find themselves in a state of enforced hibernation, waiting for a thaw that could take years, if not decades, to arrive.

The drumbeat of restrictive policies resounding from China’s regulatory bodies has set a somber tone for the country’s digital and chip industries. The recent gaming regulations, intended to corral what is perceived as unchecked digital pastimes of the youth, have sent shockwaves far beyond their immediate targets. The gaming industry, once a thriving sector that married entertainment with technological prowess, is now bracing for a stark winter, its vibrancy dimmed by the looming overcast of policy limitations.

This encroaching chill is not solely the purview of game developers and players. As delineated earlier, it reaches deep into the sinews of the Chinese tech industry, gripping the chip market with an ironclad inevitability. The data paints a foreboding picture: just as the gaming consoles ban of 2000 shuttered the window to semiconductor innovation, today’s regulations threaten to throw the industry into a regressive spiral. With gaming as a pivotal driver for chip demand and innovation, a suppressed gaming market signals dire repercussions for chipmakers who have ridden the high tide of a booming gaming economy. The specter of slowed progress and innovation looms, potentially stunting China’s aspirations to climb the silicon summit.

The historical context of the last three decades lays bare the intertwined fates of gaming and chip industries. The voracious appetites of gamers for faster, more powerful, and ever-evolving experiences have fueled an arms race in chip development. With this symbiosis disrupted, the tendrils of consequence reach into the future, promising a landscape starved of the competitive spirit that once pushed boundaries and expanded horizons.

China’s computer industry, which had just begun to emerge from the shadows of the console ban, is at risk of a relapse into dormancy. The country’s remarkable journey to global prominence in the smartphone market, propelled by a relatively unshackled mobile gaming sector, now faces a roadblock that may well unravel years of gains. The regulations loom like an overcast sky over mobile gaming’s sunlit progress, dimming prospects and chilling the warmth of innovation that has been the hallmark of China’s digital ascension.

When the tableau of today is laid alongside the image of 2000, the reflections are uncanny and unsettling. The new gaming regulations seem poised to enact a rerun of the digital and chip industries’ forced hibernation, a sequel that could play out on a grander and more tragic scale given the heights from which they might fall.

If the gaming console ban was a freeze that cost China years of technological advancement, the present regulations could be the frostbite that cripples the industry, leaving lasting damage. The potential is not just for a lull in growth but a rollback that could see China relinquishing its hard-won position at the high table of the digital world.

In the final analysis, the shadow cast by the new regulations extends beyond gaming consoles, beyond the next quarter’s financial forecasts. It stretches into the future, where the glow of screens may dim and innovation could falter. The stark reality is that China’s chip market, once burgeoning with promise, now confronts a possible future where the once-celebrated mantra of ‘faster, better, more’ is replaced with ‘halt, regress, and wait.’ This is a narrative that may unfold, not through a cataclysmic event, but through the steady drip of policies that constrict the lifeblood of an industry integral to China’s modern identity.

In the annals of digital and chip markets, policies act as both the written law and the invisible hand that can either nurture or stifle growth. For China, the hands that once fostered a digital renaissance now seem all too willing to draw the curtains on that very era. The chill in the air is palpable, and the outlook, it seems, is indeed bleak.

The landscape of China’s digital domain, once a bursting scene of competitive innovation, is now overshadowed by a curtain of regulations that leaves many within and beyond China’s borders both bewildered and concerned. As an American expatriate living in the heart of this seismic shift, the changes resonate with me on a deeply personal level.

Living here, I’ve been privileged to witness the meteoric rise of China’s tech prowess. Strolling through Shenzhen’s Huaqiangbei, an electronic market buzzing with the latest tech gadgets, gave me a palpable sense of the speed at which China’s tech industry advanced. It was a testament to a burgeoning industry that seemed unstoppable in its march towards global dominance. Yet, the recent turns of policy have cast a pall of uncertainty over this vibrant scene.

For us expatriates, these regulations affect more than just the convenience of our daily lives—they reflect a change in the winds, one that may redefine our role here and the intercultural exchange that has enriched this society. The fusion of eastern and western gaming preferences, for instance, had been a fascinating melange that I encountered in local gaming cafes and online communities. Now, I ponder what cultural amalgamations might never occur as these regulations restrict the flow of digital creativity and cross-pollination of ideas.

The global perception of China’s tech industry, too, is at an inflection point. Around the world, people have marveled at China’s technological leapfrogging, but these regulations serve as a sobering reminder that the trajectory of any nation’s tech sector is not only defined by innovation and market forces but also by the hands that wield the regulatory pen. International stakeholders, from investors to foreign companies who’ve looked to China as a bastion of growth, now face a conundrum—how to navigate this new regulatory landscape that seems at odds with the unwritten law of tech: innovate or perish.

These regulations speak to a broader conversation about the role of technology in society and governance. It’s a universal dialogue, made more poignant by China’s decision to rein in its digital sphere. Observing from my vantage point, these policies aren’t just about controlling screen time for youths; they’re a reflection of a deep-seated concern about the cultural and societal impacts of rapid technological change—a concern not unique to China but felt in capitals around the world.

Yet, there is a cultural element that cannot be overlooked. Gaming, much like other forms of entertainment, has been a cultural touchstone for China’s youth, a digital nexus where friendships are formed, where stories and experiences are shared across vast distances. As these new rules restrict gaming hours, they also limit the shared experiences that are so central to the social fabric of the younger generation.

Moreover, the weight of these changes transcends the gaming and chip industries. It’s a signal, a signpost that could point towards a broader realignment of priorities within China’s tech sector. As an expatriate, I am left to wonder how this recalibration might reshape the broader society and economy that have become my host. Will we see a resurgence of traditional industries, or perhaps a pivot towards other forms of digital innovation less susceptible to regulation?

In closing, this tightening grip on China’s gaming realm is not just a story of market fluctuations and industrial impacts; it is a story about the intersection of technology, culture, and governance. It’s about the push and pull between innovation and control, and the unforeseen ripples that emanate from such encounters.

As an observer and participant in China’s dynamic landscape, I can’t help but contemplate the broader implications of these measures, and how they will shape the experiences of those of us who have come to call China our second home. The robust conversations in expatriate circles now often revolve around these regulations, and what they portend for China’s place in the global digital economy.

It remains to be seen how China will navigate the dichotomy of fostering a world-leading tech industry while maintaining the regulatory strictures it deems necessary. For now, the conversation continues—both within the meeting rooms of tech giants and among the community tables of expatriate cafes. And through it all, I, alongside countless others, watch, wait, and wonder about the future of the digital world that has become an integral part of our modern lives.

评论