icon

password

Multi-select

tags

ID

type

status

slug

summary

category

date

Author

URL

Today, ITJuzi, China’s new economy venture capital data service provider, released the 2020-2021 Analysis of Entrepreneurship & Investment Within New-Economy in China.

ITjuzi, founded in May 2013, is a database of Chinese start-ups similar to CrunchBase. The report released this time is its eighth annual report. Supported by China Renaissance Capital Investment and Tencent News Technology Chennal.

According to the report, the theme of venture capital in China in the past 10 years is the TMT industry, and the whole industry has experienced a complete cycle. The focus of VCs is shifting from Internet companies in the previous cycle to consumer goods, retail, pharmaceuticals and chip manufacturing. Coupled with the impact of the COVID-19 epidemic in 2020 and the trade war between China and the United States, China’s VC industry as a whole is at a low ebb.

According to the statistics of ITJuzi, a total of 3886 new economy companies were invested in China in 2020, with a total financing amount of 814.5 billion yuan (about US $125.8 billion).

In this big market, 2476 (57%) companies raised tens of millions of yuan or less, and these companies took a total of 59.1 billion yuan (US $9.127 billion) from the market. Accounting for 6% of the total market transaction volume, the financing level of 1737 companies (40%) is between 100 million and 1 billion Yuan (US $154 million), and they take 331.2 billion yuan (US $51.15 billion), accounting for 38%.

On the other hand, 148 companies have received financing at the level of $150 million, raising a total of 333.5 billion yuan, accounting for 56% of the market, and seven companies have received financing at the level of $1.5 billion.

Judging from the industry distribution of investment events, the most popular investment industry in 2020 was medical and health care, with a total of 838 investments and financing of 174.5 billion yuan, accounting for 19%, followed by the new industrial sector, with 772 cases, accounting for 18%. There are 695 investment events in the enterprise service sector, accounting for 18%; these three major areas account for half of the investment events in the new economy.

In 2020, China’s new economic investment events were concentrated in Beijing, Shanghai and Guangdong, accounting for 53% of the total.

Compared with 2019, the number of investment events in 2020 decreased by 18% compared with the same period last year, the lowest in the last decade, but the total amount of investment and financing transactions in 2020 increased by 12% compared with the same period last year – showing the growing Matthew effect of the capital market.

The extremely high trading events occur frequently, and capital concentrates a large amount of money on a small number of projects.

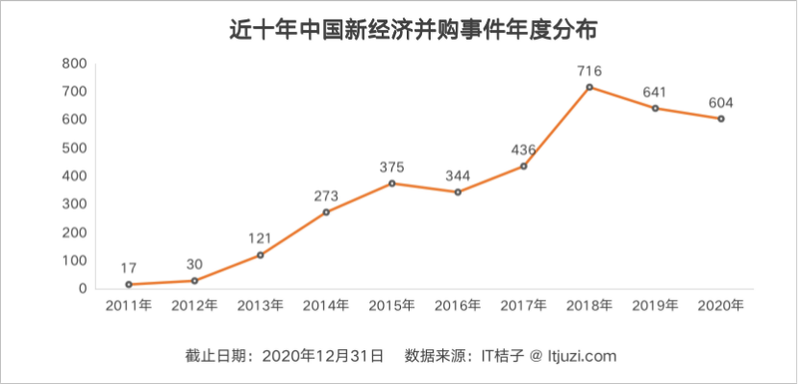

The number of financing and mergers and acquisitions of New economy companies in China from 2011 to 2020

According to the data, the period from 2011 to 2015 is the rising stage of China’s new economic entrepreneurship, and the number of mergers and acquisitions in the market has increased by 22 times in five years. From 2015 to 2016, leading by TMT, the number of transactions in the M&A market remained about 380 on average every year. Start-ups are still in the stage of being supported by venture capital, hoping to develop independently and fully compete

At this time, startups often considered about: “if Baidu, Alibaba, Tencent came to do my business, how can I against them?”

In 2018, the number of mergers and acquisitions in the new economy increased by leaps and bounds to reach a peak of 716, and remained at an average of more than 600 transactions a year in 2019 and 2020. At this stage, start-up companies can no longer continue to develop simply through the mode of burning money to expand their scale. at the same time, investment institutions have entered a rational situation.

When the capital winter comes, a large number of mergers and acquisitions within the subdivided industries begin to take place in the market. and mergers and acquisitions by giants and listed companies.

A total of 604 mergers and acquisitions took place in China’s new economy in 2020, down about 5% from 2019, according to ITJuzi data. This wave of mergers and acquisitions is beginning to show signs of coming to an end.

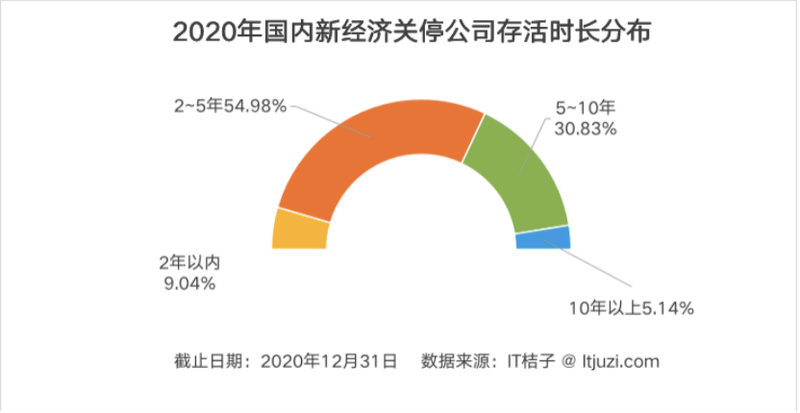

Life distribution of new economy companies that went bankrupt in 2020

Entrepreneurship and risk are like twin brothers, they inevitably go hand in hand. According to the data of ITJuzi “Company Cemetery”, the number of slightly well-known entrepreneurial projects has reached more than 14,000 in the past 10 years, of which nearly 1,000 were explicitly closed in 2020.

Of the 1000 companies closed in 2020, 9% of the projects survived for less than two years and 55 per cent died within two to five years of establishment; the average life expectancy of the company was 4.77 years (57 months).

Among the death projects in 2020, the top 10 industries include finance, corporate services, education, e-commerce, education, entertainment and media.

The report also gives a brief forecast of the trend of the investment industry in 2021. As COVID-19 does not seem to be able to “completely disappear” in the short term, and the change of government in the United States and other factors, uncertainty in the primary market will be higher in 2021.

Now, China’s VCs may be more cautious in its investment strategy. Although they are still called venture capital institutions, they prefer “risk-free” investments.

- Author:NotionNext

- URL:https://pandayoo.com/2021/01/23/according-to-the-latest-report-chinas-vcs-is-undergoing-collective-transformation-and-upgrading

- Copyright:All articles in this blog, except for special statements, adopt BY-NC-SA agreement. Please indicate the source!